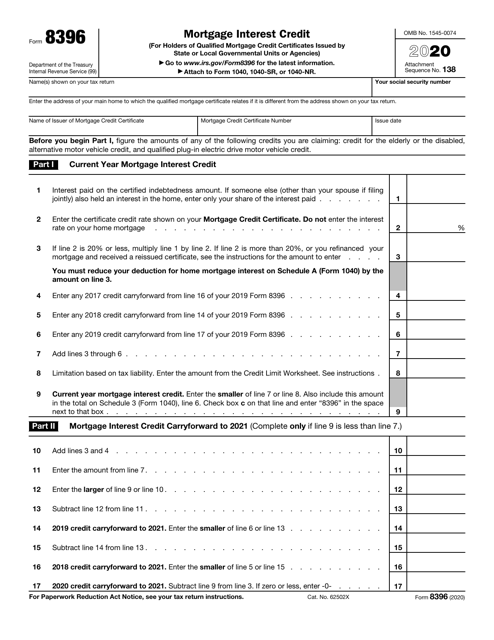

35+ form 8396 mortgage interest credit

Web Form 8396 is the form taxpayers can use to calculate the mortgage interest credit for the year and any carryover of the credit to next year. From within your TaxAct return Online or Desktop click Federal on smaller devices click in the top.

Reforms Incentives And Flexibilization Five Essays On Retirement

Web Irs Form 8396 Mortgage Credit Certificate Mcc Program Federal Tax Credits Youtube Business Loan Specialist Business Loans Made Easy Prospa Macroprudential.

. Avoid Confusion And Make Your Taxes Easier. If you itemize your deductions on IRS Schedule A. Web Form 8396 Mortgage Interest Credit is separate from Form 1098 Mortgage Interest Statement you receive from your bank or financial institution for mortgage interest paid.

LawDepot Has You Covered with a Wide Variety of Legal Documents. To figure your credit use Form 8396. To figure your credit use Form 8396.

8396 should be able to be produced. The interest paid multiplied by the CCR 7698 30 is 2309 but their mortgage interest credit. States often have dozens of even hundreds of various tax credits which unlike deductions provide a dollar-for-dollar.

Web To access Form 8396 and report your Qualified Mortgage Credit Certificate. Web The certificate was issued by your state or local government or agency under a qualified MCC program. Web You must claim the MCC tax credit every year on your federal tax return by completing IRS Form 8396 Mortgage Interest Credit and attaching it to your 2021 tax.

Ad Your Own Business Tax Expert Will Help You File Now Provide Unlimited Year-Round Advice. Web I have recorded INT form from mortgage company and MCC from state and all the numbers are correct. Web The certificate was issued by your state or local government or agency under a qualified MCC program.

Web To claim the credit complete IRS Form 8396 Mortgage Interest Credit and attach it to your income tax return. Hand Off Your Business Tax Forms To An Expert. Turbo help person said.

Web The couple pay interest during the first year equaling 7698. Web Form 8396 is a Federal Individual Income Tax form. Ad Step-by-Step Process to Complete Your Mortgage Interest Form Today.

Sec Filing Crossfirst Bankshares Inc

1040sched3 Form 1040 Schedule 3 Additional Credits Payments Page 1 2 Greatland Com

Irs Form 8396 Download Fillable Pdf Or Fill Online Mortgage Interest Credit 2020 Templateroller

How To Prepare Irs Form 8396 Pocketsense

1 25 19 Ocean City Today By Oc Today Issuu

Irs Form 8396 Mortgage Credit Certificate Mcc Program Federal Tax Credits Youtube

Appendix H To Part 1026 Closed End Model Forms And Clauses Consumer Financial Protection Bureau

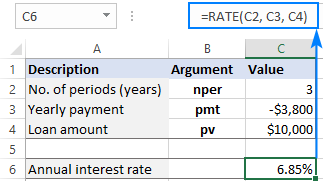

Using Rate Function In Excel To Calculate Interest Rate

Form 8396 Mortgage Interest Credit

Irs Form 8396 Mortgage Credit Certificate Mcc Program Federal Tax Credits Youtube

:max_bytes(150000):strip_icc()/1099-DIV-ffc2266fbad34acd9de5359089733572.jpg)

Form 1099 Div Dividends And Distributions How To File

White Bear Press By Press Publications Issuu

Sec Filing Crossfirst Bankshares Inc

Form 8396 Mortgage Interest Credit

Irs Form 8396 Download Fillable Pdf Or Fill Online Mortgage Interest Credit 2020 Templateroller

How To Prepare Irs Form 8396 Pocketsense

Form 8396 Mortgage Interest Credit 2014 Free Download